Rates FAQs

- Rates are a form of property tax.

- Council delivers an extensive range of services to its community.

- In order to be able to deliver these services and infrastructure without significantly

impacting on future generations, it charges annual rates. - Council will determine the rate in the dollar that it requires to meet the cost of providing

these services to the community.

- All councils in South Australia prepare an Annual Business Plan and Budget, which outlines the services, programs and infrastructure Council will deliver in the coming year.

- When setting the annual business plan and budget, a council must balance the current needs and expectations of the community with what will be required in the future to achieve the best economic, environmental and community outcomes.

- Council also needs to consider external pressures and increased costs, the amount of income available from rates, and property owners’ ability to pay rates.

- The services and programs provided by councils, and the infrastructure requirements of individual councils, vary considerably. For example, the Mount Barker District Council has a mix of residential, commercial, industrial and rural properties, and is considered a ‘growth council’ where population is expected to increase significantly in the years ahead.

- To help set rates each year, Council considers the amount of revenue needed to fund services, programs and infrastructure projects that are delivered.

- It should be noted that rates are calculated to equitably spread the collection of revenue across a community based on the relative value of each property in that area.

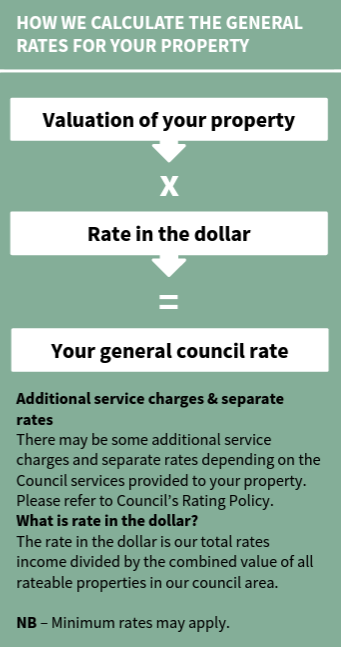

Valuation of your property x Rate in the dollar = Your general council rate

Additional service charges and separate rates

There may be some additional service charges and separate rates depending on the Council services provided to your property. Please refer to Council’s Rating Policy that's included in the Annual Business Plan.

What is rate in the dollar?

The rate in the dollar is our total rates income divided by the combined value of all rateable properties in our council area.

NB – Minimum rates may apply.

Minimum Rates – For 2023/2024 Council has set the minimum amount payable by way of general rates to $868 to ensure that Council is able to fund the basic level of service for all our ratepayers. This is equivalent to $2.38 per day.

Not necessarily.

Councils use property values as the basis for distributing the rating responsibility across their ratepayer base.

Council does not automatically receive more money because property values increase. While some people may pay more or less rates, this amount is dependent on the change in value of their property relative to the overall valuation changes across the council area.

Council budgets are set annually, with a ‘rate in the dollar’ used to ensure that the required rate income is received from ratepayers.

In simple terms, calculating how much each property contributes to rates each year involves determining the total amount of income required to maintain infrastructure such as roads, footpaths, buildings, etc and provide services and dividing this across the total value of all rateable properties to establish a ‘rate in the dollar’. The value of each rateable property is then multiplied by the ‘rate in the dollar’ to calculate the rates contribution for that property.

The following are the rate relief options available:

| Rate rebates | We provide rate rebates for certain property types such as schools, churches and some community organisations. Please refer to Council’s Rebate Policy for further information. |

| Postponement of rates |

Ratepayers who have a state seniors’ card may apply to postpone payment of rates on their principal place of residence for any amount above the first $500, which is subject to meeting certain criteria. |

| Assistance for hardship | Ratepayers experiencing hardship are encouraged to contact council to discuss their situation. |

| Rate capping |

A Rate Cap is to apply to eligible residential ratepayers’ principal place of residence to protect individuals against increased rates brought about by substantially increased property valuations. Rate Capping is available to eligible ratepayers for increases in general rates – 4% for pensioners and 12.5% for all ratepayers. Conditions apply. Applications close 31 October each year. |

- The rate in the dollar amount is determined by dividing the total general rate revenue (based upon the required services, programs and infrastructure) by the capital valuation of rateable land in the Council area.

- Council considers that the capital valuation method of valuing land provides the fairest method of distributing the rate burden across all ratepayers and that this is a reasonable indicator of capacity to pay.

- The Act allows Councils to differentiate rates based on the use of the land, the locality of the land or on the use and locality of the land.

- The Mount Barker District Council applies different rates on the basis of land use and locality. The Act allows Council the option to use a combination of factors (land use and locality) to apply different rates. Land use is recognised by other State taxing agencies and is easily identified and understood by our communities. It is therefore considered the most appropriate method for applying different rates by the majority of Councils.

- Currently the general differential rates are on the basis of category of land use as determined by the Local Government (General) Regulations 2013, with the exception of properties with the category of residential land use in the Productive Rural Landscape Zone and the Rural Zone.

- Definitions of the use of the land are prescribed by regulation and are categorised as follows for rating purposes:

- Residential (Category (a))

- Commercial – Shop (Category (b))

- Commercial – Office (Category (c))

- Commercial – Other (Category (d))

- Industrial – Light (Category (e))

- Industrial – Other (Category (f))

- Primary Production (Category (g))

- Vacant Land (Category (h))

- Other (Category (i))

- Residential 2 (Locality)

Council provides the following services that are charged separately to fund the provision of these services to recover the cost to council for the operating, maintaining and upgrade of:

- Wastewater and Sewer - Collection, treatment and disposal of wastewater and sewer (noting that Mount Barker District Council is a provider of wastewater and sewer services that would otherwise be supplied by SA Water in other areas of South Australia).

- Waste Management Charge – Kerbside waste and recycling collection.

- Recycled Water Service Charge Proposal – Portion of Meadows – Meter reading, administration and property audits.

- Meadows Non-Potable Water Service Charge – Provision of non-potable water supply to certain properties in the Meadows Township.

Section 154 of the Act permits Councils to raise a separate rate on properties, which may benefit from a project or undertaking. The main legislative features of a separate rate are:

- It can be applied to properties that benefit from the purpose of raising the rate;

- Money raised by these means cannot be put to any other use; and

- The separate rate must cease when the purpose has been completed and paid for.

The separate rates collected by Mount Barker District Council include:

- Regional Landscape Levy – This levy is a state tax. Councils are required to collect this under the Landscape South Australia Act 2019 on all rateable land.

- Mount Barker Regional Town Centre Separate Rate - On behalf of the Mount Barker Regional Town Centre Development Association Inc. applied to the commercial and industrial businesses including vacant properties and or within the defined area (Refer Rating Policy). The purpose of this separate rate is to be utilised for enhancing the commercial and business viability of the Regional Town Centre.

- Hahndorf Separate Rate - On behalf of the Hahndorf Business & Tourism Inc. applied to the commercial and industrial businesses including vacant properties and or vacant land within the defined area (Refer Rating Policy). The purpose of this separate rate is to plan and implement the marketing program for Hahndorf including promotion, marketing and the business viability of the town.

- District Wide Residential Plan Amendment Report (PAR) and Developer Contributions Separate Rate - In 2006 Council entered into Agreements with various developers and landowners that recognise the developer's concept for development of land within the Council area and the developer's willingness to construct works adjacent to or in the vicinity of the Proposed Development. This is applied to specific parcels of land and are made available to those parcels as detailed in the draft rating policy.

- Separate Rates subject to Infrastructure Contributions – The following separate rates charged on rateable land as defined below and are subject to the principles of the Infrastructure Contributions – Separate Rate Relief Policy (for further details refer to the draft rating policy):

- Transport Infrastructure MDPA Area;

- Wastewater (Sewer) Infrastructure Mount Barker MDPA Area;

- Wastewater (CWMS) Infrastructure Nairne MDPA Area;

- Recreation, Sport & Community Infrastructure Mount Barker MDPA Area;

- Recreation, Sport & Community Infrastructure Nairne MDPA Area;

- Western Sector Community Open Space Land Acquisition;

- Wastewater Commitment;

- Wastewater Infrastructure Augmentation Separate Rate (WIASR); and

- Littlehampton Development Sites Infrastructure Separate Rates Proposal;

- Littlehampton Direct Infrastructure Contribution Separate Rate;

- Littlehampton Indirect Infrastructure Contribution Separate Rate.

- Council rates are a system of taxation, much like income tax and GST, and council determines how and where they are spent.

- Rates are not a fee for service, so the amount of rates paid by a person may not directly relate to the services they use. People may not use all of council’s services all of the time, but they are there for everyone in the community when needed.

- The range of programs and services councils provided to the community, and the infrastructure requirements, differ from council to council.

- The increase in this Council’s expenditure from one year to another cannot simply be reduced to a single index such as CPI not only because of the large range of services and programs provided by Council, but also because the number and levels of service provided by Council is changing for example the footpath program, Summit Sport and Recreation Park and the Aquatic Facility.

- While Mount Barker is a growth council, and this growth results in more rates income being generated, the additional properties which are constructed (and the people that live in the new houses) also increase the need and expenditure related to Infrastructure, services and programs which support these properties and residents.